Learn Trading for Free and Without Registration

An Online Glossary to Study Trading Independently

3 Steps to the COT Report

Step 1: How to Find the COT Report

Open your browser and go to the following address:

http://www.cftc.gov/marketreports/commitmentsoftraders/index.htm.

Step 2: Where to Access the Latest Data?

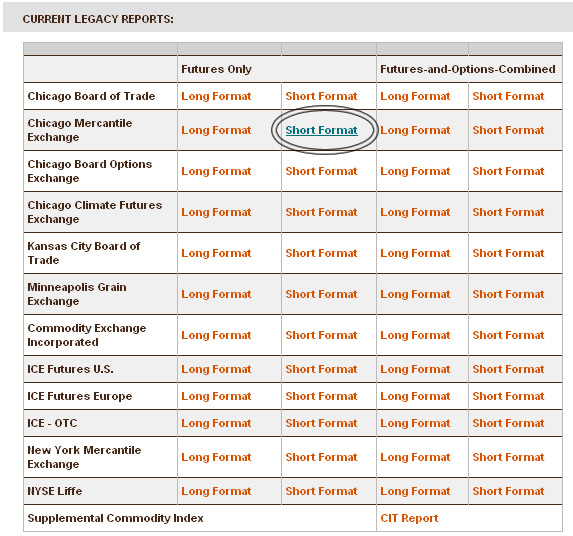

To view the most recent COT reports, navigate the site and find the Current Legacy Report section. Then, click on the Short Format link in the Futures Only section under the Chicago Mercantile Exchange platform.

Step 3: How to Analyze the Report?

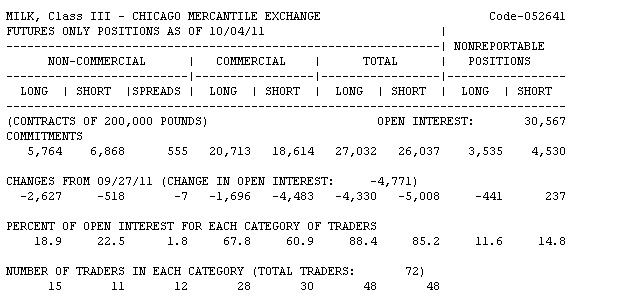

At first glance, the text may seem complex, but with a little patience and the right approach, you’ll quickly find what you need. For convenience, use your browser’s search function (Ctrl + F or a similar command).

For example, to locate data on the British Pound (GBP), type "British Pound" into the search box. This will take you to the relevant section of the report.

Decoding the Report Data

To better understand the report, let’s break down the key categories:

- Commercials: Large companies hedging against currency fluctuations.

- Non-Commercials: Traders, hedge funds, and financial institutions aiming to profit.

- Long Positions: Data on long-term trades reported to the CFTC.

- Short Positions: Data on short-term trades reported to the CFTC.

- Open Interest: The total number of open and unsettled trades.

- Number of Traders: The total number of participants required to report to the CFTC.

- Reportable Positions: Futures and options positions subject to mandatory reporting.

- Non-Reportable Positions: Positions of small traders not obligated to report, such as retail participants.

Detailed statistics are available here:

http://www.cftc.gov/marketreports/commitmentsoftraders/CFTC009781.html.

What Matters for Beginner Traders?

While the report contains a wealth of data, there’s no need to memorize everything. As a beginner, focus on the core question:

"What is the market sentiment this week?"

Understanding the general direction will help you navigate the market’s complex dynamics and make more informed decisions.