Learn Trading for Free and Without Registration

An Online Glossary to Study Trading Independently

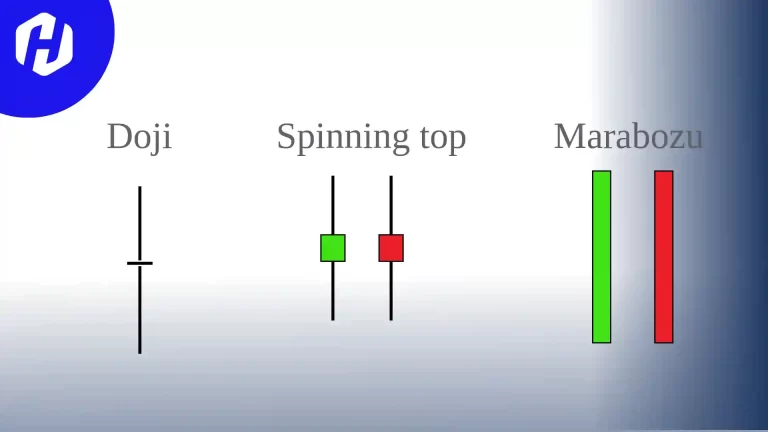

Doji, Marubozu, Spinning Top - Basic Candlestick Patterns

What is a Spinning Top, Marubozu, and Doji in Japanese Candlestick Patterns?

Japanese candlesticks are a powerful tool in technical analysis, providing traders with a visual representation of market movements and sentiment. Let's delve into three key candlestick patterns: Spinning Top, Marubozu, and Doji. These foundational candlestick formations help traders determine whether buyers or sellers dominate the market and predict potential reversals or trend continuations.

Spinning Top

Candles with long upper and lower shadows and small bodies are called Spinning Tops. This candlestick pattern indicates market indecision, where neither buyers nor sellers can gain control.

-

Characteristics of a Spinning Top:

- A small body (black or white) indicates little change between the opening and closing prices.

- Long shadows suggest that prices fluctuated significantly during the period but settled near the opening level.

-

What does a Spinning Top signify?

- The market is in a state of balance, with neither buyers nor sellers having a clear advantage.

- In an uptrend, a Spinning Top may signal buyer exhaustion and a potential reversal to the downside.

- In a downtrend, it might indicate seller fatigue, hinting at a possible upward reversal.

Marubozu

Marubozu candlesticks lack shadows, with their open and close prices aligning with the high and low for the period. Marubozu can be either white (bullish) or black (bearish).

-

Characteristics of Marubozu:

- White Marubozu:

- The lower edge of the body is the opening price.

- The upper edge is the closing price.

- It signals strong buying pressure.

- Black Marubozu:

- The upper edge of the body is the opening price.

- The lower edge is the closing price.

- It indicates strong selling pressure.

- White Marubozu:

-

What does Marubozu signify?

- A White Marubozu usually points to a strong bullish trend.

- A Black Marubozu reflects a dominant bearish sentiment.

Doji

Doji candlesticks occur when the opening and closing prices are almost equal, forming a thin body represented by a single line. This pattern signifies a balance between buyers and sellers.

-

Characteristics of Doji:

- The candle body is a thin horizontal line.

- Shadows can vary in length, leading to different types of Doji:

- Standard Doji: Equal upper and lower shadows.

- Long-Legged Doji: Long shadows on both ends.

- Dragonfly Doji: A long lower shadow and a short or no upper shadow.

- Gravestone Doji: A long upper shadow and a short or no lower shadow.

-

What does Doji signify?

- A Doji signals market uncertainty or equilibrium.

- When a Doji follows a series of white candles, it may indicate weakening buyer momentum as the market needs more buyers to sustain the trend.

- Conversely, a Doji after a series of black candles could suggest seller fatigue, potentially leading to a price rebound.

Conclusion

These three Japanese candlestick patterns – Spinning Top, Marubozu, and Doji – provide traders with crucial insights into market conditions. Understanding their structure and significance can help traders anticipate price movements and make more informed trading decisions.

- Spinning Top reflects market indecision and balance.

- Marubozu signals strong pressure from either buyers or sellers.

- Doji indicates uncertainty and potential trend changes.

Mastering these patterns enables traders to better navigate market dynamics and respond effectively to changing conditions.