Learn Trading for Free and Without Registration

An Online Glossary to Study Trading Independently

Forex Channels

Trend Channels on the Chart: How to Build and Use Them

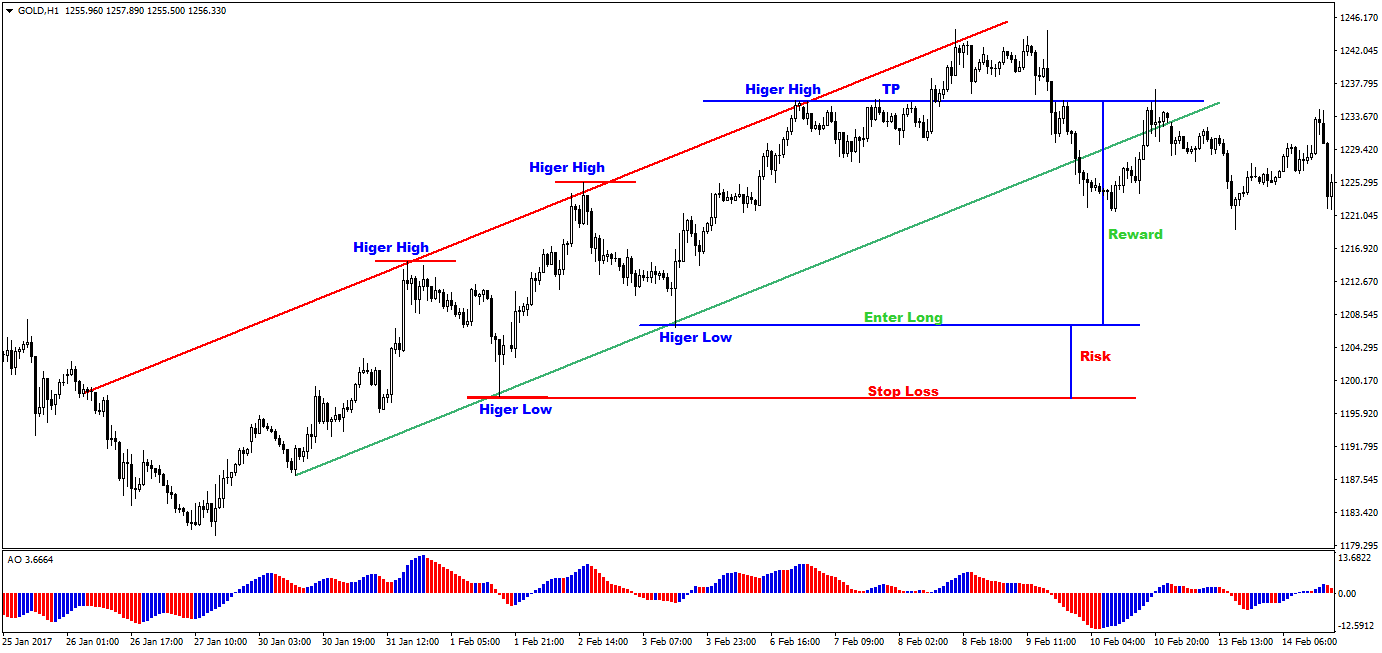

Trend channels are a powerful tool in technical analysis that help traders visualize price movements within a trend. They highlight the primary support and resistance levels within which the price fluctuates, as well as potential reversal or trend continuation points.

In this article, we will explore how to construct trend channels manually, their benefits, and how to automate the process using the Linear Regression Indicator.

What Are Trend Channels and Why Are They Important?

A trend channel is a range bounded by two lines:

- A trendline that shows the primary direction of movement.

- A parallel line that reflects the boundaries of price movement.

Trend channels help traders:

- Evaluate market dynamics. Channels show how prices behave within a range—whether the trend is steady, accelerating, or decelerating.

- Identify entry and exit points. Prices near the channel boundaries may indicate potential reversals or breakouts.

- Manage risk effectively. The channel boundaries provide reference points for setting stop-loss and take-profit levels.

Trend channels work in bullish and bearish trends, as well as in sideways (ranging) markets.

How to Build Trend Channels Manually

Building a trend channel is a straightforward process, but it requires attention to detail and adherence to certain steps:

-

Identify the trend.

Start by drawing a trendline that connects key lows in an uptrend or key highs in a downtrend. -

Add a parallel line.

Draw a parallel line to the trendline through the opposite extremes—highs in an uptrend and lows in a downtrend. -

Validate the price behavior.

Ensure the price has interacted with both lines several times, confirming their validity.

Example:

- In an uptrend, the lower channel line acts as dynamic support where prices often bounce.

- The upper channel line serves as resistance, where prices may slow or reverse.

Simplify the Process with the Linear Regression Indicator

While building trend channels manually is an essential skill, it can be time-consuming, especially in fast-moving markets. This is where the Linear Regression Indicator becomes invaluable.

The Linear Regression Indicator automatically constructs a channel using statistical methods. It calculates:

- A central line, representing the trend's average direction.

- Channel boundaries, representing the standard deviation of price from the central line.

Advantages of the Linear Regression Indicator

- Automation. The indicator eliminates the need for manual adjustments.

- Dynamic updates. The channel adjusts in real-time to reflect market changes.

- Enhanced accuracy. The statistical basis reduces subjectivity in channel placement.

How to Use Trend Channels in Trading

-

Identify Entry and Exit Points.

- Buy when the price touches the lower boundary of a channel in an uptrend.

- Sell when the price touches the upper boundary in a downtrend.

-

Assess Trend Strength.

- A narrow channel with minimal deviation indicates a strong, stable trend.

- A widening channel signals increasing volatility.

-

Trade Breakouts.

When the price breaks out of the channel and holds, it often signals the start of a new trend.

Conclusion

Trend channels are a versatile tool that helps traders analyze market structure, predict future price movements, and make well-informed trading decisions.

By automating the process with the Linear Regression Indicator, traders can save time and focus on strategy development. Learning to use channels effectively equips you with a valuable tool for analyzing any market.

Start building trend channels manually or with the help of an indicator, test them across various timeframes, and integrate them into your trading strategy!