Learn Trading for Free and Without Registration

An Online Glossary to Study Trading Independently

Forex Flag: Bearish and Bullish

The Flag Pattern in Technical Analysis: A Comprehensive Guide

The flag pattern is one of the most popular and reliable tools in technical analysis. This price pattern helps traders identify the continuation of a trend after a temporary pause. Its versatility and simplicity make the flag pattern an essential element in the arsenal of both novice and experienced traders.

What Is a Flag Pattern?

A flag pattern is a chart formation that develops as a result of short-term price consolidation within a trend. On a chart, it resembles a small parallelogram tilted against the direction of the prevailing trend.

The flag pattern consists of two main components:

1.Flagpole: A sharp price movement (impulse) forming the trend.

2.The flag: A corrective price movement within a narrow range, confined by two parallel lines.

After the pattern completes, a breakout occurs, and the price continues moving in the direction of the original trend.

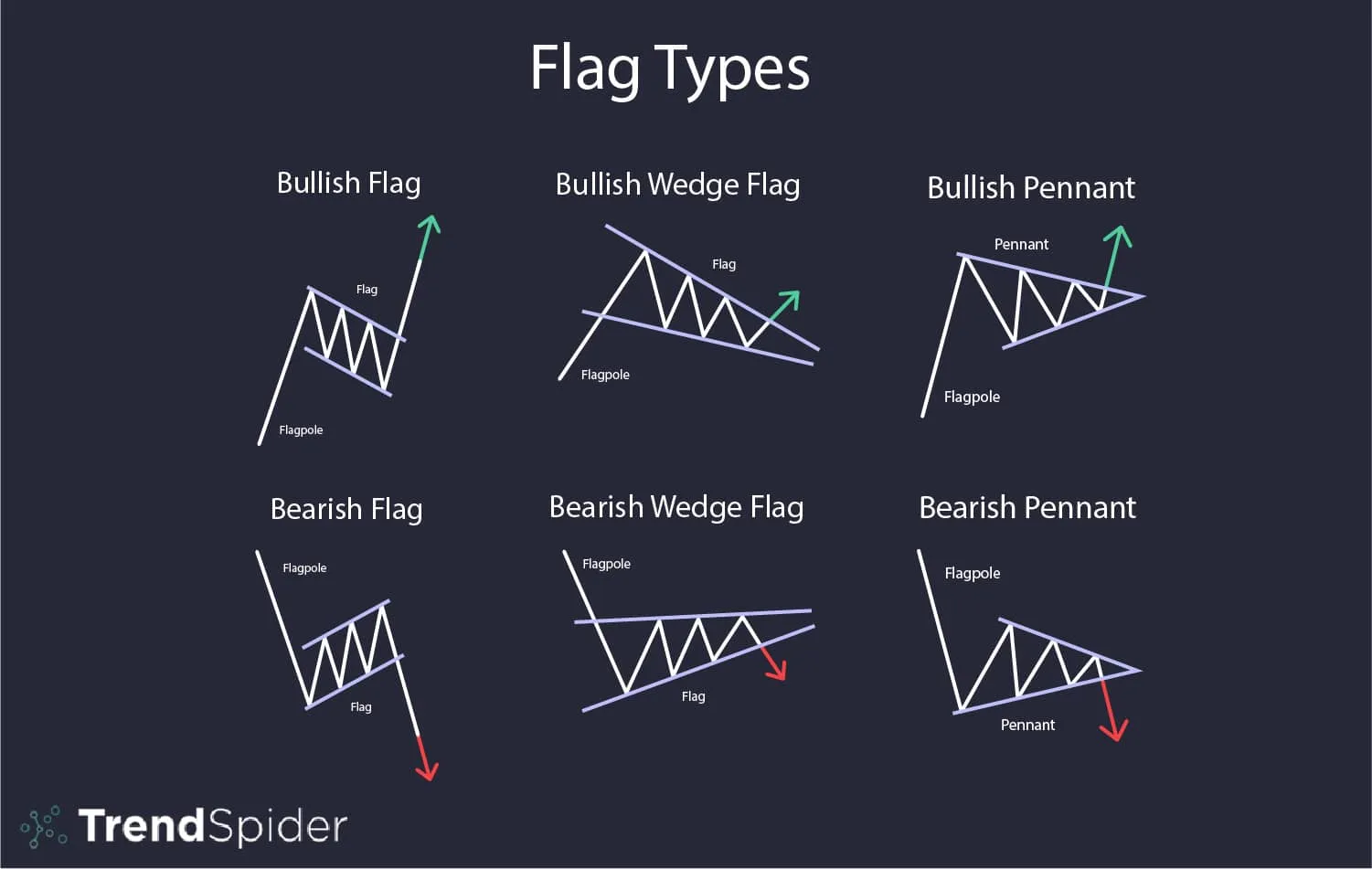

Types of Flag Patterns

Depending on the trend direction and the flag’s tilt, there are two types of flag patterns:

1. Bullish Flag

•Description: Forms within an uptrend. The flagpole points upward, while the flag is slightly tilted downward or moves horizontally.

•Signal: Indicates the continuation of the upward trend.

2. Bearish Flag

•Description: Forms within a downtrend. The flagpole points downward, while the flag is tilted upward or moves horizontally.

•Signal: Indicates the continuation of the downward trend.

How to Construct a Flag Pattern?

To construct a flag pattern, follow these steps:

1.Identify the flagpole: Locate a strong price impulse that serves as the pattern’s foundation.

2.Draw the flag: Connect the local highs and lows of the corrective movement with parallel lines.

3.Prepare for a breakout: Watch for the price to break out of the flag’s range in the direction of the prevailing trend.

How to Use the Flag Pattern

1. Identifying Entry Points

A breakout of one of the flag’s lines signals when to enter a trade:

•For a bullish flag: Enter a long position after the price breaks above the upper boundary of the flag.

•For a bearish flag: Enter a short position after the price breaks below the lower boundary of the flag.

2. Setting a Stop-Loss

Place a stop-loss order beyond the opposite boundary of the flag to minimize losses in case of a false breakout.

3. Setting a Take-Profit

Calculate the take-profit level based on the length of the flagpole. After the breakout, the price is expected to move by a distance approximately equal to the flagpole’s height.

Why Is the Flag Pattern Effective?

1.High Probability of a Successful Breakout: Flags form in trending markets, where the chances of continuation are significantly higher.

2.Clear Entry and Exit Points: The pattern provides specific guidelines for opening and closing trades.

3.Easy Visualization: Even novice traders can quickly recognize the flag pattern on a chart.

When Is the Flag Pattern Ineffective?

1.Flat or Sideways Markets: In low-volatility conditions, the flag may not form properly, leading to false signals.

2.Fundamental Events: News or external factors can abruptly change the trend, rendering the pattern invalid.

3.Incorrect Construction: Errors in identifying the flagpole or the flag’s boundaries can distort signals.

Which Markets Are Suitable for Flag Patterns?

The flag pattern is versatile and can be applied across various financial markets:

•Forex: Excellent for analyzing major currency pairs, especially during strong trends.

•Stock Market: Suitable for analyzing high-liquidity stocks.

•Cryptocurrencies: Works well in active markets with high volatility, such as Bitcoin or Ethereum.

•Commodities: Effective for gold, oil, and other assets with clear trending behavior.

Tips for Trading with the Flag Pattern

1.Wait for a Breakout: Enter trades only after the price has confirmed a breakout of the flag’s boundary.

2.Use Additional Indicators: Combine the flag pattern with volume indicators or oscillators to confirm signals.

3.Manage Risks: Always set stop-loss orders and avoid risking a significant portion of your capital.

4.Analyze Timeframes: Use multiple timeframes to validate the pattern and optimize entry points.

Conclusion

The flag pattern is a powerful tool that allows traders to effectively trade in trending markets. Its simplicity and versatility make it ideal for both novice and experienced traders.

However, like any other analysis method, the flag pattern requires practice and discipline. Combine it with other technical analysis tools to improve the accuracy of your signals. Best of luck in your trading journey, and remember—success comes to those who are willing to learn and refine their skills!